-

Covid-19 and Business Models changes for LATAM

Written on Wednesday, 16 September 2020 03:07 in Blog

Covid-19 and Business Models changes for LATAM

Written on Wednesday, 16 September 2020 03:07 in Blog

“En Rio Revuelto, Ganancias de Pescadores”. This Spanish saying means that there is somebody ready to take advantage of change, which captures well the opportunity to serve the growing digital citizens that has sprung up due to the pandemic market disruption.

Tags: latam business development latin america business when to enter into latam market how to enter into latam markets covid19 in latam IT vendors after ovid in LATAMBe the first to comment! Read 63986 times Read more... -

On Digital Transformation

Written on Tuesday, 15 October 2019 13:43 in Blog Be the first to comment! Read 4957 times Read more...

On Digital Transformation

Written on Tuesday, 15 October 2019 13:43 in Blog Be the first to comment! Read 4957 times Read more...L

atin America’s leading companies are very much committed to better serving their customers through the aggressive implementation of digital transformation initiatives.

atin America’s leading companies are very much committed to better serving their customers through the aggressive implementation of digital transformation initiatives.These efforts are being supported by Agile and DevOps principles that encompass people, processes and technology. Its fascinating to see how large enterprises in the region have launched new organizational structures around “tribes” or agile teams, for application development teams and business units alike; set goals around new metrics that measure the speed of delivery, value and quality of new or enhanced services; and the myriad of technology adopted to achieve continue integration, testing, deployment and monitoring. And although digital transformation projects are very prevalent in the financial services industry, there are also active efforts in industries such as Telco, Retail, Media, Industry, and Government.

-

The Blue Ocean and the “Old Internationalization Route” for Cyber Security Small Medium Enterprises (SME)

Written on Tuesday, 30 July 2019 00:20 in Blog

The Blue Ocean and the “Old Internationalization Route” for Cyber Security Small Medium Enterprises (SME)

Written on Tuesday, 30 July 2019 00:20 in Blog

The potential addressable market and the overall level of investment in the sector are the number one requirement that Venture Capitalists (VC) need to see before investing in software firms rising in the Cyber/Information Security sector.

Tags: latam business internationalization process cyber security on internationalization selling south latam cyber security marketBe the first to comment! Read 81135 times Read more... -

Cybersecurity companies prepare their technologies for these days!!

Written on Thursday, 13 September 2018 20:43 in Blog

Cybersecurity companies prepare their technologies for these days!!

Written on Thursday, 13 September 2018 20:43 in Blog

Traditionally, most Latin America Countries are not early adopters but when LATAM gets momentum, the market ignites.

During the last months, several countries in Latin America have been very active in their local cybersecurity regulations especially in the banking and financial industry. A mix of factors have developed a perfect storm: structural factors like the GDPR replication effect, serious hacking attacks to financial institutions in Mexico and Chile, and new regulations in countries like Brazil, Colombia, and Chile.

Tags: financial regulations affecting cybersecurity latin america financial regulations new financial regulations in latam financial regulations driving cybersecurityBe the first to comment! Read 6196 times Read more... -

The effects of the lowering cost of information on a Company's internationalization process

Written on Monday, 23 April 2018 22:44 in Blog Be the first to comment! Read 7933 times Read more...

The effects of the lowering cost of information on a Company's internationalization process

Written on Monday, 23 April 2018 22:44 in Blog Be the first to comment! Read 7933 times Read more...

IT companies with growing revenues and strong mindshare in their home market need to determine early-on when to start their internationalization processes.

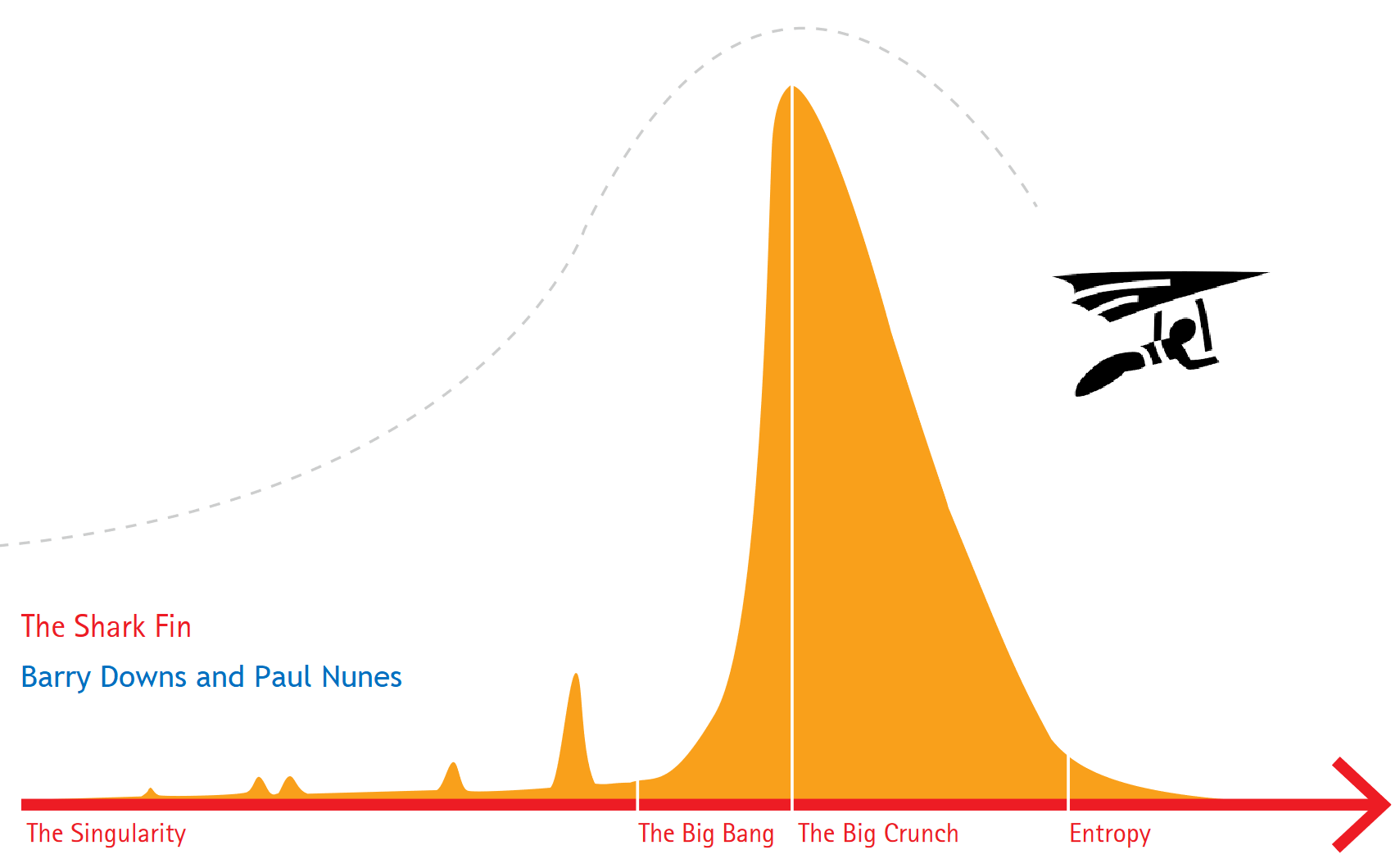

This question has become much more time sensitive and strategic as the cost of information has gone down significantly. Barry Downs and Paul Nunes, in their 2014 book “Big Bang Disruption” captures this issue well when they state:- “Consumer no longer have any excuse for making and uninformed purchase”

- “The cost of search has fallen below the cost of regret”

-

How to do business with executives in Mexico

Written on Friday, 06 April 2018 10:20 in Blog Be the first to comment! Read 7122 times Read more...

How to do business with executives in Mexico

Written on Friday, 06 April 2018 10:20 in Blog Be the first to comment! Read 7122 times Read more...

-What we learned by living and doing business with Mexican decision makers-

Mexico has one of the most iconic cultures in the world and one of the most complex to do business. Besides its well-known gastronomy, the marvelous tequila and traditional mariachi music that with any doubt contribute to support the fact that is top in the Rank of Heritage in Latin America, Mexico is also unique in the way companies and executives make business decisions. In the past 12 years doing business in Latin America I have participated in several conversations with other executives about the Mexico uniqueness in the way they make decisions. These are some notes prepared to document the Mexican way to decision making process that will provide some clues to succeed doing business with the second economy of the region. -

The Demographics of Latin America

Written on Tuesday, 20 March 2018 15:01 in Blog Be the first to comment! Read 7320 times Read more...

The Demographics of Latin America

Written on Tuesday, 20 March 2018 15:01 in Blog Be the first to comment! Read 7320 times Read more... In the book “The Rise and Fall of Nations” by Ruchir Sharma from Morgan Stanley, the author presents 10 factors that are critical for a country economic success. His first chapter is on population since demographics plays such a critical role in a nation’s wealth creation.

In the book “The Rise and Fall of Nations” by Ruchir Sharma from Morgan Stanley, the author presents 10 factors that are critical for a country economic success. His first chapter is on population since demographics plays such a critical role in a nation’s wealth creation.Countries with a growing talent of workers like India tend to experience much faster growth that countries that their population are shrinking like Japan and Italy. Note also that there is a lag between the change in GDP and population growth since it takes time for a new borne to reach working age.

-

Is the world flat?

Written on Tuesday, 20 March 2018 15:00 in Blog Be the first to comment! Read 6723 times Read more...

Is the world flat?

Written on Tuesday, 20 March 2018 15:00 in Blog Be the first to comment! Read 6723 times Read more... Anyone interested on how the barriers of commerce are disappearing has read “The World is Flat” by Mr. Freidman (http://www.thomaslfriedman.com/). Some of the concepts presented in this book released in 2005, like the 10 forces that flattened the world (open-sourcing, outsourcing, digital, mobile, etc.) are familiar subjects to executives in the IT industry.

Anyone interested on how the barriers of commerce are disappearing has read “The World is Flat” by Mr. Freidman (http://www.thomaslfriedman.com/). Some of the concepts presented in this book released in 2005, like the 10 forces that flattened the world (open-sourcing, outsourcing, digital, mobile, etc.) are familiar subjects to executives in the IT industry.Meet Mr. Pankaj Ghemawat (https://www.ghemawat.com/), who authored the recent Harvard Business Review cover article “Globalization in the Age of Trump”. Mr. Ghemawat states that people overestimate the intensity of the global business, and that cultural, administrative/political, geographic and economic factors represent major globalization hurdles.

-

Implementing a Global Strategy

Written on Tuesday, 20 March 2018 15:00 in Blog Be the first to comment! Read 7989 times Read more...

Implementing a Global Strategy

Written on Tuesday, 20 March 2018 15:00 in Blog Be the first to comment! Read 7989 times Read more...

Enterprise IT vendors goal is to operate in the WW stage. Besides the financial rewards, other market realities drive this goal: information about technology vendors could be accessed from any corner of the world; large banks, telecoms, retails, airlines, etc., are found in all regions of the world; innovating companies with sophisticated customer engagement processes are doing business in all major metropolitan areas; and the skipping of technology waves in less advanced economies that allows then to catch-up faster to new technology models. Many times, these market facts run ahead to the vendor’s implementation plans.

-

Software Development in LATAM

Written on Tuesday, 20 March 2018 14:59 in Blog Be the first to comment! Read 3256 times Read more...

Software Development in LATAM

Written on Tuesday, 20 March 2018 14:59 in Blog Be the first to comment! Read 3256 times Read more...

Software, and the “apps” and platforms (cloud, mobility, IOT) it enables, is becoming a driving force in today’s economy. Companies depend on software to serve their customers better and gain competitive advantage; cities with intense focus on digital technologies---Austin, Boston, NYC, San Francisco, Seattle-- are becoming entrepreneurship magnets.

How is LATAM’s software development sector? The answer: Doing very well and growing rapidly. The growth is fueled by several trends that should continue fostering the software development marketplace for many years in the future: -

How to Enter the Latin America Market?

Written on Tuesday, 20 March 2018 14:59 in Blog Be the first to comment! Read 5852 times Read more...

How to Enter the Latin America Market?

Written on Tuesday, 20 March 2018 14:59 in Blog Be the first to comment! Read 5852 times Read more...

How to Enter the Latin America Market?

Latin America and The Caribbean is one of the most dynamics regions in the world having an economy of US$ 6 trillion, population of 620 million people, and an IT market estimated to be $300 Billion. The size of the Brazil’s and Mexico’s economies, the new insertion of Argentina in the world financial markets, and the growth experiencing by Chile, Colombia and Peru makes this region a very interesting one for IT vendors to participate in.

As described on our blog dated March 26th, the region brings a level of complexity that requires knowledge and experience in the various countries to be successful. In addition, the current economic slowdown has caused a recession in some countries like Brazil. -

Book Review: “Wining in Emerging Markets”

Written on Tuesday, 20 March 2018 14:57 in Blog Be the first to comment! Read 2947 times Read more...

Book Review: “Wining in Emerging Markets”

Written on Tuesday, 20 March 2018 14:57 in Blog Be the first to comment! Read 2947 times Read more...

In the book “Winning in Emerging Markets” (Harvard Business Press, 2010), the authors Tarun Khanna and Krishna Paletu, who have many years studying multinational companies entering new markets, present an interesting approach on how to be successful in emerging markets. This blog highlights some of the concepts discussed in the book:

-

Is Doing Business in Latin America and the US Different?

Written on Tuesday, 20 March 2018 14:57 in Blog Be the first to comment! Read 3626 times Read more...

Is Doing Business in Latin America and the US Different?

Written on Tuesday, 20 March 2018 14:57 in Blog Be the first to comment! Read 3626 times Read more... One of the question we most commonly answer to companies entering the Latin America is if doing business South of the border is that different. The answer, similar to other international markets, is: Yes, and No.

One of the question we most commonly answer to companies entering the Latin America is if doing business South of the border is that different. The answer, similar to other international markets, is: Yes, and No.

On the No side, doing business in Latin America is similar to the US since Latin America is comprised of democratic countries with market driven economies, the rule of law, comparable vertical markets, and technology adoption that--with a time lag—mirrors the US. -

The Pacific Alliance

Written on Tuesday, 20 March 2018 14:56 in Blog Be the first to comment! Read 2885 times Read more...

The Pacific Alliance

Written on Tuesday, 20 March 2018 14:56 in Blog Be the first to comment! Read 2885 times Read more... The Pacific Alliance (PA), Alianza del Pácifico in Spanish, is one of two major trade blocks in the Latin America (LATAM), and is comprised of Chile, Colombia, Peru and México.

The Pacific Alliance (PA), Alianza del Pácifico in Spanish, is one of two major trade blocks in the Latin America (LATAM), and is comprised of Chile, Colombia, Peru and México. The GDP of the PA countries makes them the 8th largest economic power and a population of 216 M people. It represents LATAM’s 38% of GDP and 50% of trade. PA was founded in 2011 and its charter goals are: